Wine is one of the oldest investment categories in Europe. British traders have been importing clarets from Bordeaux, Port wines and Sherry for centuries. The old family adage was that you would buy 3 cases of each wine you would like to collect, 2 cases to invest and 1 to drink, the appreciation over time of the first tow paying for the free consumption of the last one.

British merchants were pioneers in selling wines from Bordeaux to their clients with investment cellar plans. The wine market has been very resilient over long period of times, showing a good level of de- correlation to any of the financial crisis.

The wine industry has always been quite keen to encourage this investing approach, as it takes a lot of time to get a fine wine produced and eventually sold to a client. The work in the vineyard is nearly a year, as soon as a harvest has taken place, you need to prepare the next vintage, work in the vines and on the soil. Planting, grafting, pruning and harvesting are all different stages of what will happen in a global wine estate for many of its parcels year after year. After that long and costly process in the vines, comes the winemaking, followed by a resting period in more and more sophisticated cellars which are major assets, and for the best chateaux another 2 years of cellaring will follow prior to the final bottling.

With a 3 years cycle from the vine to the bottle it is no wonder that some wineries have been willing to accelerate their cash cycle and have pushed to find clients in the first year following the harvest. This started with Bordeaux which champions the en-primeurs (future sales) as an investment opportunity.

Futures in wine are based on a vintage, which has already been harvested and the wine made but not bottled yet. The process in Bordeaux, which leads the category and has created it, is to invite every year in April, six months after the harvest, all the key critics to rate the vintage and their wines and to invite shortly thereafter all the key merchants around the world to come sample and evaluate the quality of the last vintage This is no small feat, as each year thousands of people flock to Bordeaux to taste from the barrel hundreds of wines which are so young that little of their merits have been revealed yet. Based on the level of enthusiasm of that week of tastings and the on the critics scores, chateaux will determine how much they can hope to charge for their wines to maximize their

cash-flow and earnings.

Things are changing though in the industry. Historically, chateaux were selling almost all their production and few were keeping stock for the future, however since the departure of the en-primeurs model from Chateau Latour (now owned by Francois Pinault), many chateaux have realised the importance of keeping some of their production in stock to be released under optimal conditions in the future.

One of the drawbacks of the historical investment model is that private investors when buying wines to invest would be selling their stock on an ongoing basis; so some were kept till optimal maturity, but many investors, seeking a quick return for their cash, would sell their wines only a few years after they were acquired. This means that the investor willing to cash in early (2 to 4 years) needs to find an interested buyer who is willing himself to carry the inventory for a few more years till the wine is ready for consumption (5 to 10 years is a typical cellaring time for a good Bordeaux).

There are several issues with that process:

• the first one is that if the wine is not ready to be drunk, the new buyer will seek to buy it at a discount to factor his own future cellaring period

• The second one is that, for a futures buyer, the wine -which is a fragile product- is being moved potentially several times before reaching its final point of consumption. By doing so the wine conditions change, it may be transported and cellared to perfection but more often than not it will be moved at different period of the year in non refrigerated trucks and may potentially suffer whilst gaining miles …

A wine from a first growth can often change hands 3-4 times before being drunk, which may result in damages to the expected end product. Chateaux very well understand this and so want to protect their most precious assets whilst balancing their cash so that when the day comes, they can release wines with no mileage to the top destinations in the world; and get their wines to shine with the end customer, who will order them to be drunk.

Another issue in the world of fine wine investments is that all wines which are great to drink may not turn into great collectible for investments purposes. This is linked to the rapidly changing demands of the consumers globally, where beside some obvious choices in wines as assets, many wines may be great to drink but may not have a real after market value. This creates a liquidity issue for investors as with the lack of market benchmarks comes the lack of float, you get back what people may think the wine is worth. Beside that comes the question of where would you sell these wines.

Platforms have emerged in the last five years where you see a peer to peer model, such as Wine Owners or Cellar Tracker, where people bid and offer their wines as on any trading platform. The issue there is that you need a very large number of members to any of these platforms to get anything close to the market price. It is not unusual to see bidders on these platforms offering a substantial discount to the market price as the float is too small to match the professional market. This puts the investor at a direct disadvantage in the quest to maximise his investment.

Many of the historical merchants are seeing the need to help their clients liquidity to continue to sell to them more wines, so beside the peer to peer solutions, these merchants are doing the same now with broking exchanges where their clients can offer live the wines they bought from them. Here again one could dispute the merits of buying a wine from a merchant who will need to take a margin and then hope that the wine will appreciate enough over time to cover the storage costs (typically Euros 10-15 per case per year), the cost of money and hope that after the buyers premium there is still enough money left to make a good profit. These models are all fine if your passion for wine is the main driver of you purchasing wine, but it will be very time consuming to trade your cases at the right time with the right price and enough volumes to get any serious cash back in your wallet.

An alternative to the physical investment whether as futures or on the secondary market, is to invest through financial vehicles such as investment funds. Many wine funds in the past were totally unregulated and people were sold wine investments on the phone, often through brokers who had no direct access to the market and which were buying on the secondary, often even tertiary broking market. The number of people who got burnt there was huge and the EU regulation of 2014 of turning alternative assets as a regulated product was a welcome change in the industry.

Today the best funds will have a clear set of governance:

• an investment committee to manage the portfolio and not a single guy

• a regulated offering supplement vetted by the financial authorities

• a clear set of fees with reduced costs for the investors

• a clear way to redeem your investment and a good level of liquidity

• an independent administrator beyond the world of wine

• independent and secured custodians to validate the assets are real and tangible

• an independent evaluator to ensure the Net Assets Value of the Fund is not inflated

• auditors to review the compliance and the respect of the investment principles.

If your fund is meeting the above criteria, then analysing its track record should be a good indicator of the investment. You can then invest in the wine category without having to become yourself a broker/trader of fine wines. Maybe less fun than doing everything by yourself but if you have not been bitten by the wine bug probably this is the soundest way to invest in the category.

Review of the Wine Source Fund, a Fund under the microscope:

We have decided to screen some funds on the market, which could meet our investment check list. This is how the Wine Source Fund answers that grid:

• an investment committee to manage the portfolio and not a single guy: WSF has a committee of 5 people from wine investment to compliance, financial risks and diversification

• a regulated offering supplement vetted by the financial authorities

• This Fund is regulated by the financial authorities of Malta with a European passport, it has an ISIN number and a monthly reported share price on Bloomberg and Morningstar

• a clear set of fees with reduced costs for the investors

• Fees are at 2% of the Assets Under Management per year and a performance fee of 20% above a hurdle rate of 6%, so no performance fees for the first 6 percentage points of return

• a clear way to redeem your investment and a good level of liquidity

• Liquidity is quarterly after a lock-in period of 12 months

• an independent administrator beyond the world of wine

• The Fund is today independently administered by BPO Fund Management

• independent and secured custodians to validate the assets are real and tangible

• The Fund is storing with the main bonded warehouses in UK and France (LCB Vine – Octavian – GCS in Bordeaux) – Assets are insured at NAV and inspected yearly by the auditors.

• an independent valuer to ensure the Net Assets Value of the Fund is not inflated

• Assets are being valued by Wine Owners, a composite of Wine Searcher low and Livex data taking an average of 400 datapoints by wine each month.

• auditors to review the compliance and the respect of the investment principles

• The Fund is audited by Deloitte Malta

• A sound level of performance for your money

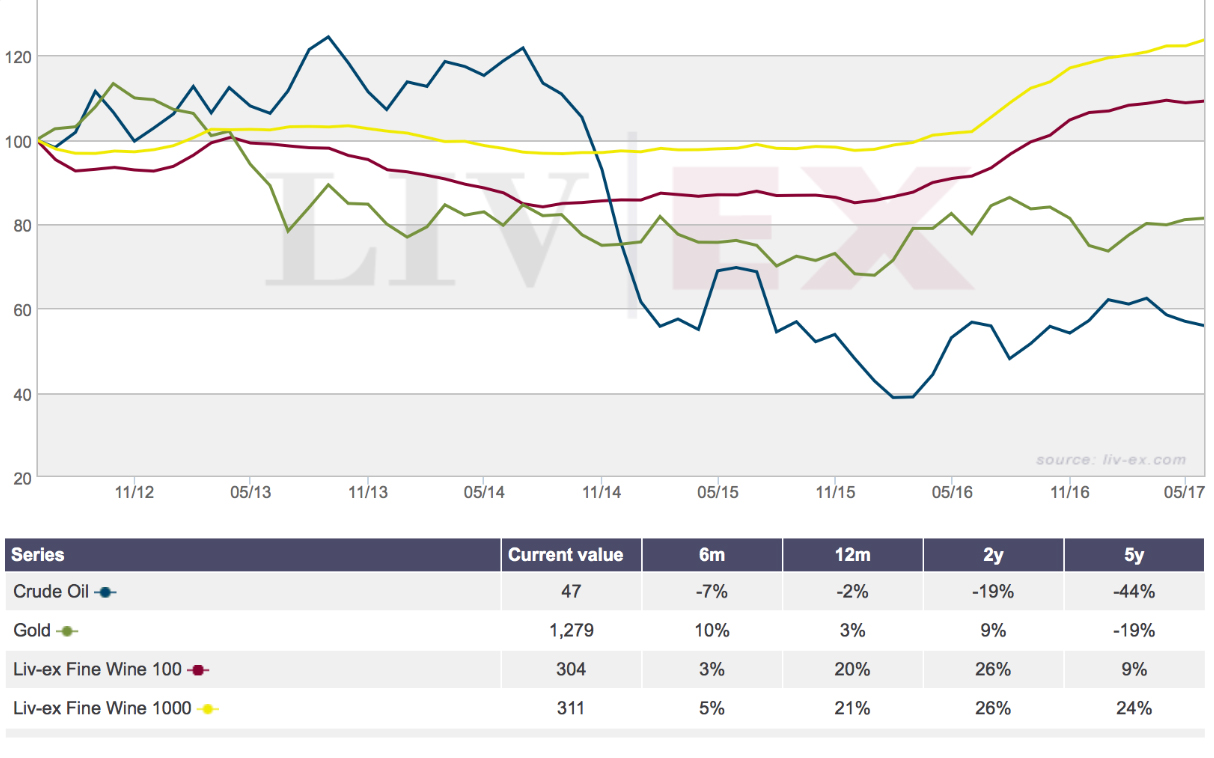

• The Fund has returned on average 7.4% net per year to its investors

Show Comments +